In spite of the government’s attempts to carry out reforms, the Investment Attractiveness Index of Ukraine is not improving. For example, the index calculated by the European Business Association continued to show a downward trend for three quarters in a row, dropping to 2.18 out of the maximum 5 in the first quarter of 2012. Seventy seven percent of the business managers polled by the association said there were no changes for the better. It looks like the investment situation in this country also forces big investors to call into question the necessity of further large-scale investments. For example, the market is rife with rumors that the European Bank for Reconstruction and Development (EBRD), Ukraine’s largest international investor, is planning to cut down its investments. The final decision about crediting the energy and agrarian sectors will be made after a delegation of the bank’s shareholders visits Ukraine in late September 2012 to, so to speak, personally see the investment climate and put certain questions to this country’s leadership. In an exclusive interview with The Day, Andre KUUSVEK, EBRD Director and Country Manager in Ukraine, assured us that the bank shareholders’ September visit is just of a routine nature. But the business climate in Ukraine really leaves much to be desired, so the bank’s current investments are a far cry from its capacity.

Could you please confirm or deny the information to the effect that your bank is planning to decrease funding for Ukraine. What has caused such a step?

“At the moment, there is no decrease in funding: in the first half of 2012, the EBRD signed up for roughly 350 million euros in new projects. First and foremost, it is up to Ukraine to decide if the amount of financing will be reduced in future. In the private sector, everything will depend on the demand and the quality of the projects, while in the public sector, on the speedy implementation of reforms and the quality of the proposed projects.”

Which exactly reforms do you mean?

“The principal reforms, necessary to continue with the current amount of investment, are those in the price sphere. I mean the energy sector and gas price formation. The worst problem with the public sector is that the present prices do not even cover operational exploitation costs, let alone including amortization in the prices (which would allow to modernize the out-of-date infrastructure and communications, built as far back as in the 1970s-1980s).”

If public utility prices are not modified, to bring them to level with the economically valid rates, does this mean that the EBRD will not finance energy efficiency public projects in the public utility sector?

“It is not quite so: crediting will proceed at a low rate. At present, in some municipalities we are cooperating with local governments to implement heating systems modernization projects and working on the upgrading of energy efficiency of public utility companies in energy and heating sectors. To this end in 2012 we have only spent 50 million euros so far, whereas our potential portfolio for such projects amounts up to nearly 300 million euros. It will be a challenge to launch large-scale crediting for municipal utility projects without a reform of pricing policy.”

You have permanent contacts with businesses, which makes you a sort of live barometer for investor sentiments. Could you say you feel that over the recent year it has been easier for businesses to work in Ukraine?

“No, the investment climate has not improved. The sentiment among entrepreneurs does not in the least suggest anything of the kind. There still is too much red tape and subjectivism in important business-related decision-making. Speaking of corruption, in disputable situations this subjectivism very often plays in the hands of those who do not deserve it. Therefore, the improvement of the country’s investment climate is the most urgent challenge for Ukraine, and this problem should actually have already been solved. It puts real obstacles in business’ way, because business management has to waste too much energy and time to fight Ukrainian bureaucracy and corruption.

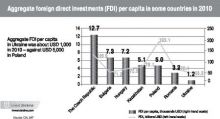

“Nor has there been an increase in big international investors. During the four years of my experience with the leading global companies, only a few big players have come to Ukraine. It is a bad sign for Europeans, as it alerts them to problems with the transparency of running a business. So the conditions for business must be made as easy as possible, and the interference of state in all spheres of economy must be minimized.”

“STATE-OWNED COMPANIES SHOULD OPERATE ON COMMERCIAL BASIS, IN A COMPETITIVE ENVIRONMENT”

How is the change of tendering legislation going to affect business conditions, since state-owned companies are entitled to purchasing products without holding tenders?

“All state-owned companies which cooperate with us play by our rules, so these changes will not affect our projects. Speaking of their overall impact on the market, it is negative. State-owned firms are part of the market, just like everyone else. And I see no reason why they should be granted some preferences, compared to the other players on the market. Non-alternative public purchases are also unacceptable. State-owned companies, just like all other, should work on commercial basis, in a competitive environment.”

Early this year Guenther Oettinger, European Commissioner for Energy, said that by mid-summer 2012 the EBRD and the EIB would have decided on the volume of the funding for Ukraine’s GTS. Have they?

“We do not refuse to participate in the upgrading of the GTS, and at present we are engaged in negotiations with the government, the EU, the European Investment Bank, and the World Bank. The delay is caused by the Ukrainian party’s procrastination in complying with the requirements, necessary for the allocation of loans.”

“IF UKRAINE does NOT LOSE ITS TRANSIT POTENTIAL, IT MUST PROMPTLY AND TRANSPARENTLY REFORM THE NJSC NAFTOhAZ UKRAINy”

What do you mean? The gas market legislation has been passed, and the restructuring of the NJSC Naftohaz Ukrainy into separate companies (PJSC Ukrtranshaz and Ukrhazvydobuvannia) is in progress, isn’t it?

“We welcome the beginning of the restructuring of the NJSC. But the transformation of its structure has to comply with the general ‘roadmap’ of reforming the country’s gas industry, and fit the framework of the new “Energy Security Strategy until 2030.” It is the latter document that caused a number of issues with the government, and it took a long time to come to agreement about them. For one, there were debatable issues concerning the increase of the proportion of renewable energy until 2030 and better safety for all of Ukraine’s nuclear power plants. As far as the latter goes, the EBRD, jointly with Euratom (the European Atomic Energy Community, or EAEC), could allocate, by the end of 2012, nearly 300 million euros to upgrade safety systems at all Ukrainian nuclear power plants. We have already implemented similar projects in the nuclear energy sector.”

Speaking of the GTS and its modernization, what must be done there?

“In order to launch funding, the restructuring of the NJSC alone is not enough. As I have already said, there should be a roadmap, compatible with the new energy strategy until 2030. Besides, the World Bank has sent some proposals to the government concerning the consultations in the process of the restructuring. These proposals are now under consideration, and only after they have been signed, the next step is possible: joint funding of the modernization of a section of the Urengoy – Pomary – Uzhhorod pipeline. We still plan to invest nearly 300 or 400 million euros into it. The timelines of allocation of the funding depend on how fast Ukraine will implement all that is mentioned above. If Ukraine does not lose its transit potential, it must promptly and transparently reform the NJSC Naftohaz Ukrainy.

“If the EBRD begins to fund this project, it will become a signal for further work with the NJSC Naftohaz Ukrainy in the framework of the project of the GTS modernization both for us and other investors. And here it is also necessary to raise the question of consumer gas prices. If Ukraine does not bring these prices to a commercially valid level, any participation in the modernization of the GTS will turn out commercially wasteful. It is no whim of ours, but objective reality. Today Ukraine pays more than 400 dollars per 1,000 cubic meters of Russian gas, while consumer prices cover only a small proportion of this price. If this practice prevails, the NJSC will continue to suffer losses, whereas our bank cannot finance wasteful companies [On August 10, 2012, vice prime minister for social policy of Ukraine Serhii Tihipko said in Dnipropetrovsk that gas consumer prices for the population and public utility and energy companies would not be raised. – Author].”

The procrastination with investments into the modernization of Ukraine’s “gas pipe” is also generally ascribed to the fact that in Europe’s gas market spot contracts prevail, comprising 54 percent of all actual gas purchase contracts. So it looks as if Europe need not sign long-term contracts with Gazprom for purchasing gas and consequently, for its transportation via Ukraine. Do you think this is going to be a factor in the GTS’s investment attractiveness?

“The gas market has indeed changed over the past years, as well as pricing policies and sources of gas supply. Liquefied gas and shale gas are becoming increasingly popular. The buyer seeks for cheaper resources. Therefore, it is no longer important to harmonize the gas price with that of oil, as it used to be done before. But I cannot say for sure if this is a long-term tendency or a temporary phenomenon.

“Yet despite all this, Ukraine’s GTS still remains an attractive object. A survey by MottMacDonald shows that its modernization would be much more lucrative than the construction of the South Stream pipeline. Notably, this is a difference amounting to billions of dollars. Besides, Ukraine has another obvious competitive advantage. The huge underground gas storage reservoirs in the west of Ukraine allow the GTS to remain quite an attractive object, despite all the unfavorable factors. Europe has no storage facilities to match these.”

“AT PRESENT THERE IS NO ONE THERE TO DISCUSS CONSORTIUM WITH”

Is the idea of consortium still timely, under the current conditions of restructuring?

“Yes, it is.”

Are you negotiating it?

“No. We only join in the game when there are real investors in sight. We do not know if there are any at present. But we are interested in an option like consortium. We are prepared to join in any talks about a consortium to manage the GTS, but at present there is no one there to discuss it with. A lot also depends on the composition of the consortium. Our key mission is support to private business, so we would like to see real private investors with expertise and good reputation.”

If the GTS management is handed over to a group of interested Ukrainian companies, is the EBRD likely to agree to participate in such format?

“We do not rule anything out, but at present it is too early to speculate on the subject.”

You mentioned you would stake on crediting renewable energy projects. Can we get a closer insight on these plans?

“Yes, we are interested in investing in the nonconventional sources of energy. So far this year the total amount of investments in this field has only been 30 million euros, and these projects are small. We are interested in all kinds of alternative energy projects: wind farms, solar batteries, and hydroelectric energy.

“We would also like to finance shale gas production and the Black sea shelf gas fields development. But I cannot say anything specific on the account of these two, since the EBRD does not have any experience in crediting such projects yet.”

Does the bank plan to participate in the financing of the liquefied natural gas terminal construction on Ukraine’s Black sea coast?

“We would like to discuss this matter, but it is possible to start real work only after a private investor joins the project or a consortium of investors is created. It is unrealistic to work solely with the state.”

In May 2012 you said that the EBRD would issue hryvnia bonds. How come this has not been yet implemented?

“Ever since May we have seen the government’s desire to vivify the activity in this direction. However, the state has a question: in what way will the EBRD hryvnia bond issue affect the domestic market? The government is afraid investors would prefer those bonds over the state ones. Other countries have the same misdoubts too. But we always consult the governments on terms and conditions of entering the market before issuing stock in order to avoid hampering each other. On no condition does the EBRD intend to compete with the state.”

So, it turns out that the main barrier for hryvnia bonds is the appearance of a powerful competitor for a state on the domestic loan market?

“Yes, but since May 2012 we have seen the government’s willingness to find a way to help international finance institutions to launch hryvnia bonds.”

So why is it not possible to accomplish this, if there is willingness?

“Some technical issues remain unsolved. For example, some amendments to the law on stock market were made, which let the IMF issue hryvnia bonds. This sounds very good. But in practice the amounts of issues, stock profitability, and their use must be coordinated with the government. Of course, there can be no stock issue by international finance institutions on terms like these.”

The bank invests much in Ukraine’s agricultural sector. In what way will the adoption of the existing version of the Law “On the Land Market” affect Ukraine’s agricultural sector?

“Its existing version will hurt large agricultural holding companies, since they will not be able to buy or lease sufficient area of land for cultivation. This means they will not be able to function effectively. After all, everyone will lose: manufacturers, raw materials processors, and the state which will lose a part of income from the agricultural sector. That is why I think that Ukrainian land market has to develop according to the principles of market economy. And all the talk about putting restrictions on land purchase is the Soviet-time backlash. Perhaps, at this point of time it would be better to use the system of unrestricted lease relations.”