The favorite expression of any informed participant in the stock market can be phrased as follows: normal work in this sphere requires silence. However, the government’s initiatives aimed at bringing order to the stock market threaten to disrupt this silence. At least leaders of professional associations share this belief. The government’s intention to revoke the president’s order creating a single clearing depositary on the basis of the open joint-stock company Interregional Stock Union (MFS) has thus caused uproar.

In 1999 the American organization USAID and the World Bank signed a memorandum with the Ukrainian government to create a privately owned nationwide clearing depositary that would serve all participants of the Ukrainian stock market. The Americans provided five million US for this project, while the government promised to facilitate the development of this institution. (At the time only the MFS, a depositary formed by stock market participants, was operating on Ukrainian territory.) This project resulted in the creation of the National Depositary of Ukraine (NDU), with 86 percent of its shares belonging to the state and controlled by the State Commission for Securities and the Stock Market. MFS representatives disparage the new depositary, claiming that it was created primarily to attract Western investments. However, these hopes were not fulfilled: the memorandum envisions that, according to international practice, the country should have a single depositary, and ideally it should not be controlled by the government. For this reason the MFS was granted the functions and powers of a central depositary under the presidential order “On the general principles of operation of the National Depositary of Ukraine.”

Now, according to stock market participants, following the government’s decree the currently operating nationwide clearing depositary MFS will be forcefully replaced with the National Depositary of Ukraine, and the new structure will be controlled not by all participants of the stock market, as practiced internationally and as has been the case in Ukraine until recently, but by the state alone. Stock market participants say the government’s decree is a legally questionable document, as it will remove the final obstacle to the collapse of the current Ukrainian depositary system.

Stock market operators are mostly alarmed by the government’s intention to use the NDU to control the stock market, a task that will become much easier once the decree becomes effective. Notably, aside from revoking the presidential order, the Cabinet of Ministers has decided to recall Ukraine’s signature from the memorandum, thereby irrevocably securing the exclusive right to manage the stock market. Operators believe that this carries the threat that the government, which owns a controlling stake in the depositary, will be dictating its will and punishing dissenters. In the past it was difficult to use the depositary for corporate interests because none of its shareholders even had a blocking stake. The largest stake, 9.94 percent, belonged to the First Stock Trading System (PFTS). According to Vadym Hryb, general director of the investment company Tekt, once the depositary passes to the government, this will increase the risk of political interference in the operation of stock market institutions, which might result in loss of confidence on the part of foreign investors, followed by an outflow of funds. He also said that he would not rule out worsening relations with the World Bank and USAID. These institutions have already appealed to the country’s leadership, expressing their concern with the government’s intent to recall Ukraine’s signature from the memorandum.

However, a possible deterioration in relations with the West and the establishment of government control are not the only concerns. According to MFS chairman of the board Mykola Shvetsov, the NDU not only falls short of legislative requirements, but is also not helping the market at all. “This year’s budget provides 32 million hryvnias for supporting and developing Ukraine’s national depositary system. Budget allocations were much smaller before. Since 1998 allocations for supporting the stock market exceeded 3-3.5 million hryvnias a year. In reality, this money was used to develop the NDU. The money was not really used to benefit the system.” According to Shvetsov, none of the current NDU managers can report where the money went. Instead, with each passing year they demand more money to support and develop their operations. Echoing his colleague’s words, Vadym Hryb pointed out that the undertaking to increase the capabilities of the NDU to the level of capabilities of the MFS will cost the state budget one billion hryvnias over the next five years.

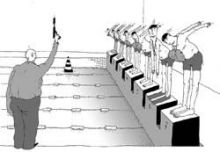

Yevhen Hryhorenko, general director of the Ukrainian Association of Investment Business, expressed his incredulity at the government’s desire to subordinate the depositary system. Repeating the classic definition, he said that a depositary is a predominantly technical system that has to serve market participants and not dictate rules to them. Hryhorenko believes that the government’s intent to invest the depositary with law enforcement functions makes one question the depositary’s “ability to serve the market’s interests.”

Stock market operators have never been pleased with the government’s actions in this sphere. Every government decree relating to their interests has always touched off an avalanche of indignation. According to Dmytro Sapunov, member of the board of COMEX Securities, “the government is behaving like a bull in a china shop,” undertaking such clumsy actions in a stock market that is only trying to gain a foothold. As soon as anything starts working in the market, the government moves in to levy requisitions on this structure, preventing it from gaining momentum, says Sapunov.

Stock market participants intend to contest the government’s decree in court. According to Hryhorenko, under the current legislation the government may not own more than 25 percent of stock in similar structures. Should the government go ahead with its plans to expand the NDU’s functions, stock market participants will file a lawsuit. In the meantime they are hoping that the government will hear them out and come to a “wise decision.”

There are several takes on this problem. The Day heard an opposing opinion from Volodymyr Ulyanov, chairman of the board of the National Depositary of Ukraine:

“I am ashamed of our stock market, which considers itself seriously. How can market participants protest the fact that their operation is being brought into the framework of the law? The law “On the national depositary system” includes all functions envisioned by the law in the National Depositary’s terms of reference. Meanwhile, the memorandum whose revocation is being protested restricts these functions. The memorandum is not a law, as it has not been passed by parliament. According to international treaties, it can become part of our legislation only after this procedure. So it seems to me that the Cabinet of Ministers has decided to bring the operation of the national depositary system in line with legislation and revoke the memorandum, which was never ratified.

“As for the stake that the government is allowed to own in a depositary institution, the law indeed says that it may not exceed 25 percent. But the law also distinguishes between a simple depositary and a national depositary. No limit is envisioned for the latter. As for corporate conflicts that the government will resolve in its own favor, as some allege, I have a counter-question: Are there any problems with the National Bank due to the fact that it is not managed by market participants? Why should there be any problems with the National Depositary? Moreover, the make-believe freedom and independence of the MFS does not correspond to the truth. In reality, since a meeting of MFS shareholders has not been held for a long time, all control is in the hands of the board that is chaired by the Ukrsotsbank chairman of the board.”