Now that Ukraine has still to figure out where it really is, at the bottom of the crisis or starting to rise above the lowest economic level, this society badly needs positive signals. Here is perhaps the first one. On March 10, the National Bank of Ukraine lowered the refinancing rates for overnight bank loans against government bonds from 15.5 to 12.5 percent per annum. For so-called blank loans, which are granted collateral-free, lenders will be charged 13.5 instead of 17 percent interest. Another piece of comforting news is that the NBU’s refinancing of commercial banks amounted to 1.6 billion hryvnias in February, compared to 1.4 in January (with the 13.1-percent annual average interest rate).

What does this mean? This dramatic drop in the refinancing rate, with the NBU tending to increase loans to the commercial bank, allows the latter to lift the de facto moratorium on crediting the real economy.

Ukraine is expecting even more positive signals from the International Monetary Fund, although it is biding its time. Caroline Atkinson, Director of the IMF’s External Relations Department, recently informed that they were looking forward to the formation of the Ukrainian cabinet that would be prepared to discuss the situation with them. So far, she said, the stand-by arrangement with Ukraine “stands where it has stood for a while. And we have been looking forward to there being a government establishment placed and ready to talk to us about taking it forward.”

Ukraine is still waiting for good news, considering that the mass of contradictions in the domestic economy remains to be untangled. Regrettably, experts agree that the banking system remains the riskiest segment of the Ukrainian market. The banks’ low crediting levels and poor loan portfolios, active government borrowings on the domestic market, low investment activity carried out by businesses and the population are all paving the way for further recession in 2010. This negative signal comes from Expert Rating’s analysts. “We can predict that Ukraine won’t get out of this crisis easily… An optimistic 2010 scenario will be zero GDP growth… There is nothing with which growth can be financed… We predict continued recession in 2010,” says Vitalii Shapran, head of ER’s analysis department.

On March 10, Greek Prime Minister George Papandreou warned that the crisis could continue on the world market, markedly in Europe, which is of special importance to Ukraine. He believes that the deep financial crisis his country is going through can trigger another global one. Greece’s huge public debt, amounting to 13 percent of its GDP, is already telling negatively on Europe, stressed Papandreou. This can produce a domino effect, boosting the cost of loans for a number of other countries with big public debts.

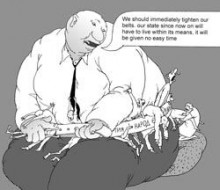

Ukraine’s public debt ($30 billion) is often regarded as relatively small, but if one takes into account the debts accumulated by the corporate sector, the sum total is over 100 billion (90 percent of GDP). This is a very negative signal. It means that all of us have to start learning to cut our coat according to our cloth. Anna Gurska, an expert with the Warsaw-based OSW Center for Eastern Studies, believes that keeping government expenses in line with budget receipts is the biggest challenge the government put together by President Viktor Yanukovych will face. She notes that by adopting even an extremely frugal budget for 2010, the government will not be able to stabilize the situation. This, in turn, will increase the likelihood of financing the budget by monetary emission or by adding to the public debt.